November 25, 2014

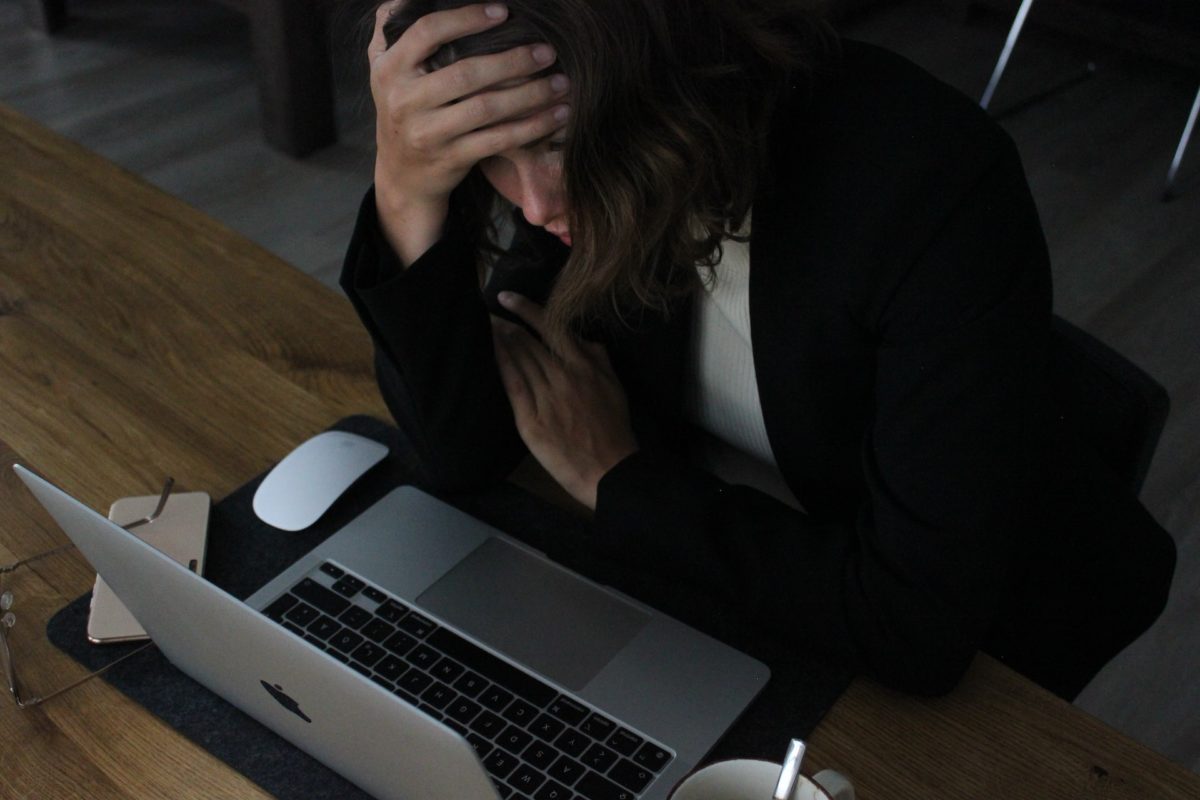

Avoiding the Holiday Spending Hangover

Written by Rachel Eddins

Posted in Stress Management and with tags: Holidays

Imagine that it’s January.

The holidays are over and the bills start to arrive. Do you think, “I said I wasn’t going to overspend again this year”?

- Do you beat yourself up for failing to keep your resolve in the face of the barrage of invitations to splurge?

- Would you be willing to try a different approach, starting now, than you used last year, and the year before that?

Avoiding the post-holiday spending hangover takes clarity about what’s really important to you about the holidays and making the moment-by-moment choices to act in a way that’s consistent with those values.

Experiences Can’t Be Bought

Now, imagine the happiest holiday times from your childhood. If you don’t have happy memories, imagine your dreams for a happy holiday.

Do those times of happiness focus on the material aspects of the holidays, or do they focus on precious moments of connection with loved ones (including yourself!) or the sacredness of your faith, or of giving back to your community?

This is where you want to focus your time, energy and money during the holidays. These are experiences that can rarely be bought.

How to Avoid the Financial Hangover

From a practical perspective, avoiding the financial hangover means that you know ahead of time how much you can afford to spend on the holidays, and making intentional plans that allow you to stay within those limits.

For many, this means sitting down with family, including the younger generation, and talking about what matters most to each person, what role will spending play in fulfilling these values and setting a spend plan to match.

Follow These Steps:

- Set a budget that is within your family’s means. If the budget is tiny, recognize that now and plan accordingly. This doesn’t mean you don’t have something of value to give.

- Make a list of who you and your family want to give gifts to and get an idea of what you want to give to each person and how much that is likely to cost. Add up the costs. Chances are good that the totally will be higher than your budget.

- Resolve the budget challenges through family dialog based on what’s important to you all. This may mean cutting the list of recipients or the cost for each gift or agreeing not to exchange gifts. It may mean home-made rather than store bought gifts. It may mean given tokens that can be redeemed for gifts of love, like hugs for grandmother and grandfather or breakfast in bed for mom or dad.

- If you need to shop, shop with your final list.

- Use cash. When the money is gone, it’s gone.

- Shop with intentionality. Go where you need to go to buy what you need to buy and then leave the store. Temptation is everywhere. If it strikes, make the choice, in the moment to act consistently with your values. If you need more incentive, picture the post-holiday hangover and what that feels like.

With clarity about what really matters to you about the holidays, with planning and intentional action, you can emerge from the holidays having felt their warmth without giving yourself a post-holiday spending hangover.

Grounding & Self Soothing

Get instant access to your free ebook.

7 Mood-Boosting Tips

Get instant access to your free ebook.

Why You Feel This Way

Get instant access to your free ebook.

Create Healthier Thoughts & Feelings

Get instant access to your free ebook.