June 4, 2012

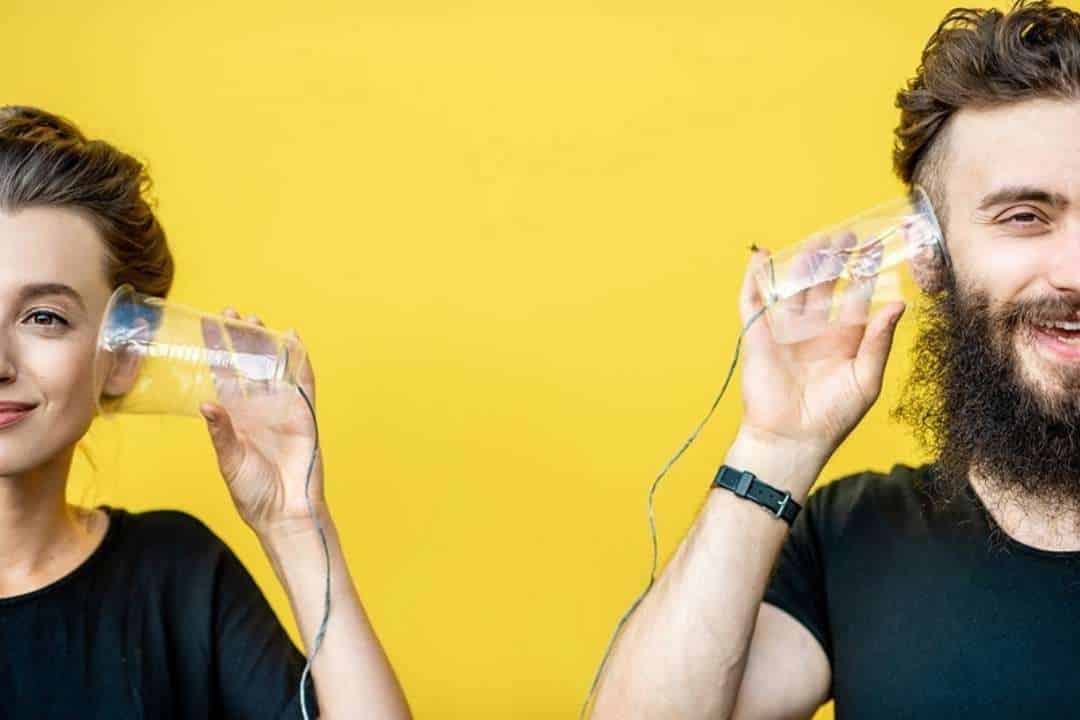

Relationships and Money

Written by Rachel Eddins

Posted in Relationships, Couples, Marriage and with tags: self improvement

Relationships and Money

Do any of these statements sound familiar?

- We always argue about money.

- She doesn’t handle money right.

- He runs through money like water.

- I feel like we’re drowning.

- Our money stuff never gets taken care of.

Disagreements about money within the family are common. Money is one of the top two areas of conflict between partners.

Communicating about money is often challenging:

- Money can be an emotional issue between the two of you.

- Money can be considered a taboo or uncomfortable topic.

- It can be challenging to communicate with one another on a feeling level.

- Money communication often requires negotiation.

- We all have our own personal set of filters through which messages pass.

The Association for Financial Counseling and Planning Education has developed some helpful worksheets that can assist couples in communicating about money and learning more about each partner’s perspective on money.

In addition to budgeting and financial planning, worksheets to explore the following points are included.

Your relationship with money is not a simple one.

There are many different money personalities, which are influenced by emotions, expectations, and experiences. Issues involving money are often emotional issues.

Money personalities fall on a continuum between saver and spender. Extreme money personalities are not ideal.

Both you and your partner may have different money personalities and behavioral traits. Your money personality also nurtures the money personality of your child/children.

Test your money personality by completing the Money Personality Worksheet G. Share your money personality worksheet with your partner.

Evaluate the financial distress felt by each partner by completing the Financial Well-Being Assessment, Worksheet I. Share your results with your partner.

Complete the Goals and Motivations Worksheet H to understand why you each want what you want.

Ways of handling money in a partnership:

Money decisions involve setting policies such as how much to spend or save. Both partners should be involved in these types of decisions.

Money tasks involve handling the money such as paying bills and routine shopping. Money tasks can be handled by one partner.

Building a budget is an important way to realize what is most important to you and your partner. Set priorities in your budget to determine what actions are most important to take.

This can also help reduce conflict about money since goals and expectations are clear. Worksheets A-E are designed to help you plan your budget and set goals for your future.

The more you both communicate about money topics, the better your money relationship.

Contact one of our counselors for help on relationships and money. Our Houston therapists are available for in-person and online therapy sessions in limited areas.

To get started now give us a call to schedule an appointment at 832-559-2622 or schedule an appointment online.

Recommended Reading:

Combining a complete self-help and self-discovery regimen with proven methods of money management, this powerhouse guide to prosperity presents twelve principles that will help you to:

- Uncover the hidden landscape of beliefs, patterns, and habits that underlie and sometimes subvert your everyday use of money and personal resources

- Tame the dragons of driven behavior and busyholism

- Defuse fears of deprivation and scarcity

- Embrace and work through paradox and confusion

- Consciously focus your money energy

- Clear yourself to receive the energy and support of others and the universe

- Develop and stay on your personal path to abundance.

Grounding & Self Soothing

Get instant access to your free ebook.